They may cancel your card so it can no longer be used and send you a new one with a different card number. If you notice a fraudulent charge on your credit card statement, contact your issuer immediately to report it. Credit card protections like this may offer a greater sense of security. When it comes to fraudulent charges, your liability on your credit card is limited to $50 under the FCBA however, many card issuers offer fraud protection and zero liability protection to help keep you safe in case any unauthorized charges are made with your card or account information. If you don't dispute the charge within the time frame, you may be responsible to pay the charge. The time limit may also depend on your card issuer, so check your cardmember agreement to confirm how much time you have. You typically have 60 days from the statement date that reflects the unauthorized charge to dispute it. Regardless of the issue, it's important to contact the merchant first and try to resolve the matter with them.

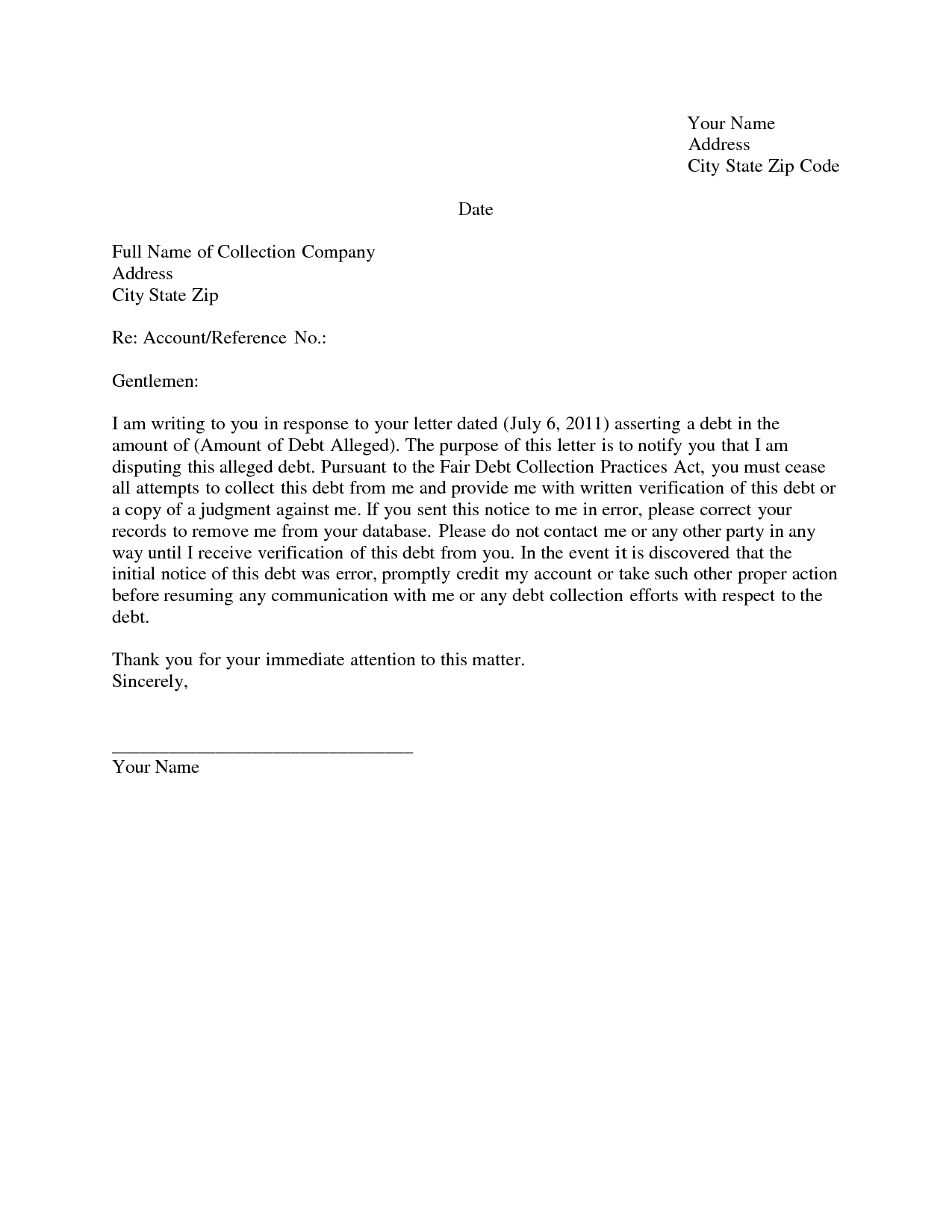

To dispute a credit card charge, you may need to provide copies of receipts and any other supporting documents you have. Before contacting your credit card issuer, contact the merchant first. Credit card charges can be disputed by calling the card issuer, and some credit cards allow you to submit disputes online or by mail.

Whether there's an error, fraudulent charge or dissatisfaction with the goods or services provided, you have the right as a consumer to dispute a credit card charge.

0 kommentar(er)

0 kommentar(er)